Tax on Agriculture Income and Capital Gains from Agriculture Land Sale in India

In India, the tax treatment of agricultural income and the capital gains resulting from the sale of agricultural land are subjects of vital importance to landowners and farmers. This article provides an in-depth look at the exemption rules for agricultural income under Indian law, explores the implications of the partial integration rule with precise calculations, and delves into the capital gains tax liabilities for both urban and rural agricultural land sales. We also review significant case laws that have shaped the understanding and application of these tax rules.

Understanding Tax Exemptions for Agricultural Income

Agricultural income in India is exempt from income tax as outlined in Section 10(1) of the Income Tax Act, 1961. This exemption is meant to support agricultural activities which are the backbone of the Indian economy. The exemption covers income derived directly from land via agricultural activities such as cultivation or earnings from agricultural produce.tax on agriculture income

Applying the Partial Integration Rule: A Calculation Example

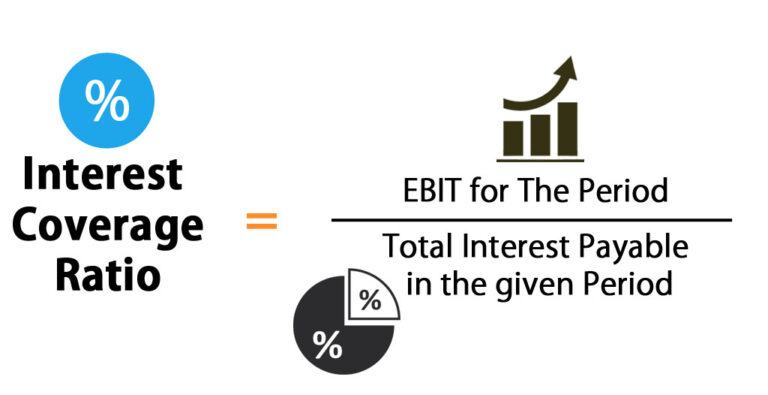

The partial integration rule is crucial for taxpayers who have both agricultural and non-agricultural income. This rule helps determine the tax liability in a way that effectively taxes significant agricultural income when combined with other income sources.

Example Calculation for Tax on Agricultural Income:

-

- Non-agricultural income: ₹500,000

- Agricultural income: ₹300,000

- Standard exemption limit: ₹250,000

-

- Calculate tax on combined income (₹800,000), and separately on the standard exemption plus agricultural income (₹550,000).

- Non-agricultural income: ₹500,000

The actual tax payable is the difference between these two calculations, ensuring agricultural income over a threshold indirectly affects total tax due

Key Case Laws Impacting Tax on Agricultural Income

Commissioner of Income Tax v. Raja Benoy Kumar Sahas Roy (1957):

This Supreme Court decision is critical for understanding what constitutes agricultural activity under the tax law.

Godrej & Boyce Mfg. Co. Ltd. v. Deputy Commissioner of Income-Tax (2017):

This recent case clarified the criteria for agricultural land within urban limits regarding capital gains tax.

Capital Gains Tax on Agriculture Land Sale: Urban vs. Rural

Capital Gain on Urban Agriculture Land Sale

Urban agricultural land, when sold, might attract capital gains tax if it is located within municipal limits or near urban areas as defined by the Income Tax Act. The owner must calculate capital gains as the difference between the sale price and the indexed cost of acquisition, potentially leading to significant tax liabilities.

Capital Gain on Rural Agriculture Land Sale

Conversely, rural agricultural land may be exempt from capital gains tax if it has been used for agricultural purposes consistently. This exemption encourages the continued use of rural land for agriculture rather than its sale for development purposes.

Conclusion

Navigating the tax implications of agricultural income and the sale of agricultural land requires careful consideration of Indian tax laws and applicable case law. With detailed records and proper planning, taxpayers can effectively manage their tax obligations related to agricultural activities and land sales. It is advisable for stakeholders in the agricultural sector to consult with tax professionals to ensure compliance and optimal tax treatment.